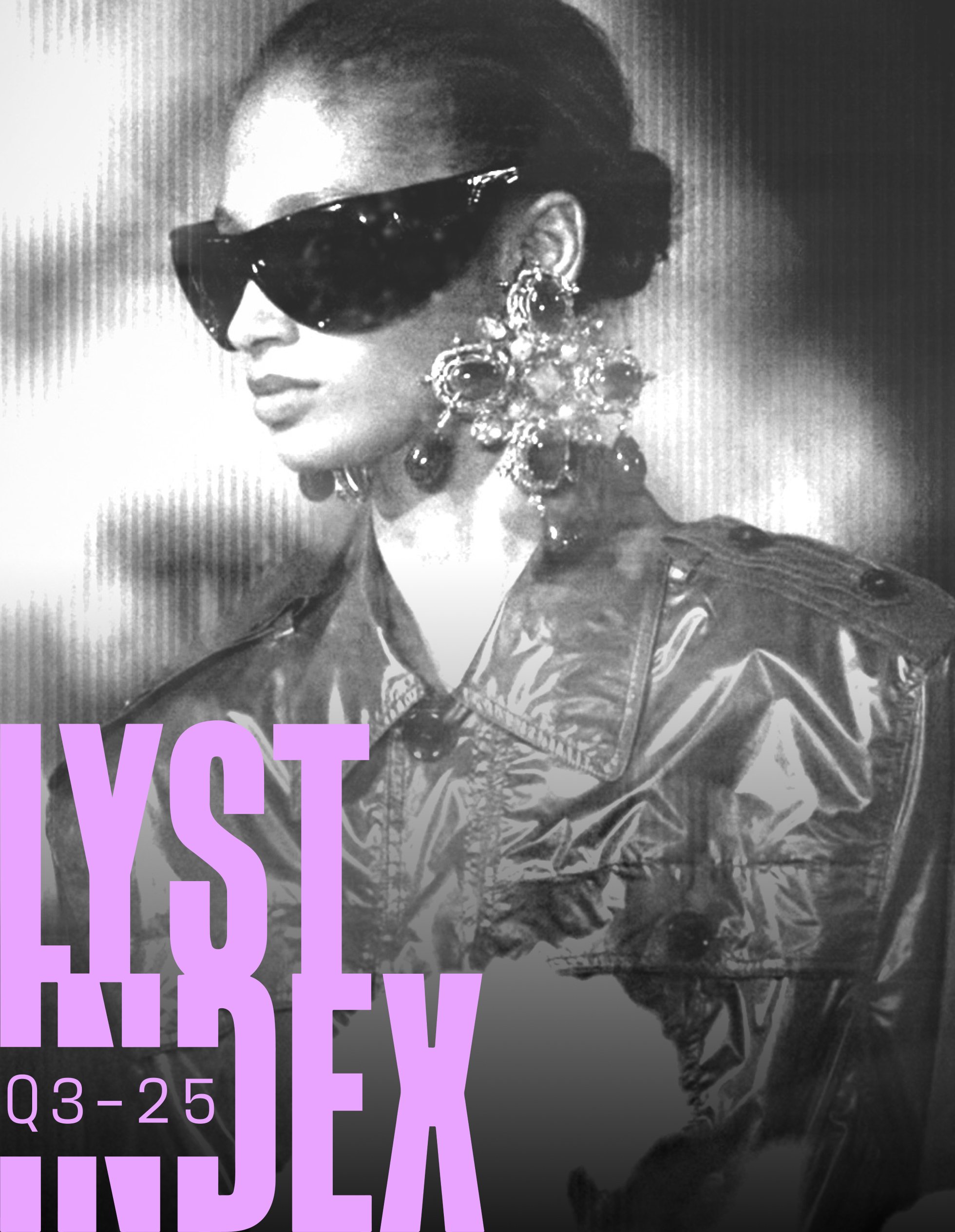

Saint Laurent Steps Up

LYST

The Q3 Lyst Index lands at an inflection point for fashion. The season reflects an unusual mix of moods, uncertainty for brands mid-transition, and clarity for those doubling down on what they do best. All but three brands in the table moved position this quarter, with the biggest swings coming from COS’s breakthrough into the top three, up four places since Q2, and Loewe sharply feeling the loss of Jonathan Anderson, moving down six spaces.

Amid creative reshuffles and collection recalibrations, one thing feels clear: the brands winning right now are those who know who they are.

Saint Laurent strides confidently into first position, for the first time. Where others rewrite their codes, Saint Laurent’s handwriting has only become sharper. The consistency of silhouette, slick sensuality, and unshakable confidence continues to cut through the noise. Searches for Le Loafer, Q3’s 2nd hottest product, rose an average of 66% month-on-month during the quarter. Priced at $1k, the shoe distills the Saint Laurent philosophy: refined, subtle, sophisticated.

Is ‘Quiet Luxury’ still sustaining demand? The data shows simplicity and restraint continue to resonate with consumers seeking understated pieces across price points. Moving up four positions, COS becomes the world’s third hottest brand, with a 147% increase in searches this quarter. The COS chunky cashmere sweater, last appearing in Q4 2024, returns as one of this quarter’s hottest items. The style encapsulates the brand’s appeal: architectural restraint, understated warmth, and tactile minimalism that feels grown-up without stiffness. Meanwhile, The Row moves up two spaces into fourth position, with demand up 28% this quarter. In Q2, its flip-flop defined a summer trend; this quarter, the Eel loafer dominates searches, sitting neatly in an aesthetic dialogue with Saint Laurent’s own.

Still in fifth position, demand for Coach on Lyst rose 29% this quarter, with strong social buzz supported by high profile sports ambassadors, product placements in The Devil Wears Prada 2 and partnership with The Summer I Turned Pretty. The Empire bag, this quarter’s tenth hottest product, helped anchor the brand’s summer success. Another American brand seeing digital, culture-led growth is Ralph Lauren, rising two places with a 6% quarterly increase in searches. Taylor Swift’s engagement announcement, in a striped Ralph Lauren dress (number nine in the hottest products) became an online flashpoint, blurring the line between celebrity endorsement and skillful brand storytelling.

147%

increase in searches for COS on Lyst this quarter

COS

STONE ISLAND

115%

increase in demand for Stone Island on Lyst this quarter

American brands are resonating outside of the Top 20 too. Madewell saw 34% growth this quarter, riding the wave of the mall-brand renaissance bringing brands like Gap and American Eagle back into the online conversation for younger shoppers. Brands are effectively capitalizing on moments of social media virality and tapping talent more relevant to Gen Z (such as Sydney Sweeney and Katseye), to reach these audiences in their digitally native context.

There’s movement in the middle of the pack. Burberry climbs four positions with a 14% lift in demand this quarter as Daniel Lee’s recalibration finds its audience. SKIMS continues its product-driven ascent, with demand now up 271% year-on-year. Viral launches like the Face Wrap sustained cultural dominance and led customers back to hero pieces like the Nipple Bra, which saw a 69% spike in searches this August, once again proving the brand’s ability to turn conversation into conversion. Stone Island re-enters The Index after four years outside the Top 20, with a strong 115% quarter-on-quarter rise in demand. A long-time pillar of casual subculture, the brand garnered mainstream attention this quarter, supported by the halo effect of Oasis’s reunion shows — evidence that identity, when deeply rooted, can transcend trend cycles.

Is Nike back? A 7% rise in demand on Lyst this quarter predicts a comeback may be on the cards. With two products in the hottest list (the Nike Shox and the Nike x Jacquemus Moon Shoe) the brand proves that a combination of design, nostalgia, and collaboration remains a winning formula. Under new CEO, Elliot Hill (appointed at the end of 2024), Nike has returned to its roots, pivoting back to performance and innovation to focus on athlete-led design and strategic partnerships, including the Nike Skims collaboration launched at the very end of the quarter.

Taken together, Q3’s results reveal a fashion landscape regaining balance after several volatile seasons. New creative leads are still settling, but those with a defined direction, like Saint Laurent, The Row, and COS, are proving that conviction is the key to clarity. It’s time for brands to be brave; the world’s hottest aren’t following the rhythm, they’re setting the tempo.

JACQUEMUS

Nour Hammour

Nour Hammour

Known for sharply tailored leather outerwear, the Paris-based label blends Parisian polish with a subversive, biker-inspired edge.

worn by:Kendall Jenner, Gigi Hadid, Rosie Huntington-Whiteley, Hailee Steinfeld

Trending Product:Hatti Jacket

+49%

QuARTER-ON-QUARTER RISE IN DEMAND

Nike

A global benchmark for performance and innovation, Nike fuses sport, culture, and design into generation-defining products.

Worn by:Jacob Elordi, Jennifer Lawrence, Dakota Johnson, Kendrick Lamar

Trending Product:Nike Jordan 4, White Cement

+7%

QuARTER-ON-QUARTER RISE IN DEMAND

MADEWELL

Madewell

A heritage American brand built on denim and ease, Madewell champions unfussy, timeless staples that balance comfort with quiet style.

WORN BY:Dakota Fanning, Rachel Zegler, Jenna Ortega

Trending Product:Transport Early Weekender Woven Tote

+34%

QuARTER-ON-QUARTER RISE IN DEMAND

To request information or images relating to The Lyst Index please contact

press@lyst.com